German Effort Aims to Put Monetary Value on Human Capital

What if business executives and investors could put a dollar value on an organization’s human capital in a way that could be compared between companies, industries, even categories of employees? That’s the goal of a group of professors at the University of Saarland in Saarbruecken, Germany. They have not only developed this formula, but have tested it on at least three companies, are working with other academics in Europe to refine and improve the platform and are open to working with organizations in the U.S. and throughout the world to further develop the formula. The objective is to create a real-time calculator that organizations can use at any time to determine changes in human capital value.

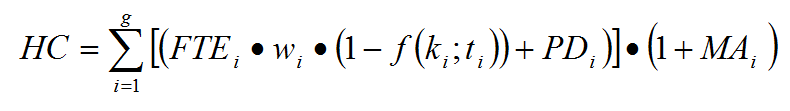

Known as the Saarbruecken Formula, the measurement process and mathematical calculation outlined below aims to provide executives and investors with an objective way to not only place a monetary value on human capital, but also provide guidance as to how best to invest in human capital to achieve desired results. The formula was developed by: Prof. Christian Scholz (University of Saarland), Prof. Volker Stein (University of Siegen), and Dr. Roman Bechtel (Alumni of University of Saarland).

Their work is especially important now that more U.S. investors are demanding concrete metrics on human capital and related investments (See $26 Trillion Investor Coalition Sees Link Between Human Capital Management and Shareholder Return), and now that the International Standardization Organization is creating standards on human capital management. Note that one of the contributors to the Saarbruecken Formula is on the ISO committee that is developing these standards. See ESM: Q & A With Stefanie Becker….

In a white paper by Dr. Christan Scholz, Volker Stein and Stefanie Becker (formally Muller), the authors define human capital as “the performance potential which is created by the existing skill and capability pool represented by the entire staff. The human capital value then represents the minimum expected value creation of the workforce.” According to the authors, “the performance potential can only be determined through core Human Resource Management (HRM) activities with a clear performance relationship independent from the present entrepreneurial success on the sales side. This performance potential of a company therefore consists at least of the existing employees, priced with the market value of their salaries, of their equipment, up-to-date knowledge, as well as of their motivational situation, which is mainly influenced by HR management.” (Please note, minor corrections were made by ESM editors from the original report.)

By their definition, “the value of the human capital is not to be linked to business turnover (sales): The value of the staff does not change automatically if the enterprise gains or losses profit or if the stock price changes. The prevalent definition of present human capital management points out that human capital is not only a residual value of financial data, but a synthetic monetary value which aggregates several characteristics of people and of human resources management activities in a systematic and systemic way.” The authors say that their process contributes to the long-term prosperity of an company by placing a monetary value on the people-bound human capital of the workforce and “the process-bound human capital which is the result of human resources management activities.”

While the formula below appears daunting to those mathematically challenged, the professors have already developed three different versions of spreadsheets: a simple version, a more complex one, and a version for students – all only in German at the present time – to process the data collected:

Essentially, the above formula determines the dollar value of human capital by identifying employee groups or clusters based on educational levels, job categories and levels of hierarchy. It factors in the number of full-time equivalents (rather than full-time employees); the average market-based wages for each employee group; the average life-span of knowledge for each group (how many years before they require new training in each job position); average length of time with the company; the human resources development costs for the last 12 months for each employee group; and the motivation index (i.e., the level of employee engagement.)

The professors have received funding from the German Federal Ministry of Education and Research to put their formula to the test with real companies. So far the professors have used this numerical process to provide a human capital valuation for three organizations that also clearly showed the return-on- investment of the organizations‘ respective investments in human resources management. One company is from the German financial sector, with about 600 employees; a second company is from the automotive industry, with about 400 employees; the third company produces convenience goods, with about 360 employees. This is not just a measure for large companies. In all three cases the return-on-investment of human capital investments was $1.80 or more for every $1 invested.

For more details on the formula, click here.

For their work on empirical evidence, click here.

The professors are interested in hearing from organizations who wish to learn about the software or their work on human capital measurement.

For information, contact:

Prof. Christian Scholz